Topics

Services

- 228 results found

Publication

|

Podcast

In episode #1 of INNOPAY’s “Meet the Vendor”, onboarding team lead Guy Rutten talks to Maarten Wegdam, founder and director of Innovalor. Innovalor is the company behind ReadID, an NFC chip reader that lets you onboard in seconds.

In our series “Meet the Vendor” we introduce you to parties in the market that can help improve yo...

Lesen Sie mehr

Publication

|

Blog

“Data, whether it's location-based or behavior-based data, will help provide solutions, whenever and wherever they occur.” – Brett King, Autor von breaking banks

Obwohl sich Versicherer bei der Optimierung der ‘customer experience‘ beim Onboarding deutlich verbessern, scheint die Preisgestaltung immer noch das wichtigste Unterscheidungsm...

Lesen Sie mehr

Publication

|

Blog

This article was first published in The Paypers which features thought leadership editorials from ecommerce and payments industry professionals.

The concept of Open Banking and its potential grows steadily on corporate banks. PSD2 has been an important catalyst for banks in opening up, however, it forced them to focus on complying first,...

Lesen Sie mehr

Publication

|

Blog

This article was first published in the legal journal Payments & FinTech Lawyer (04/04/18)

Fostering an innovative environment: a pragmatic guide to embracing innovative CDD technologies while effectively managing the associated risks

Financial institutions are investing heavily in technology to improve one of their initial interact...

Lesen Sie mehr

Publication

|

Blog

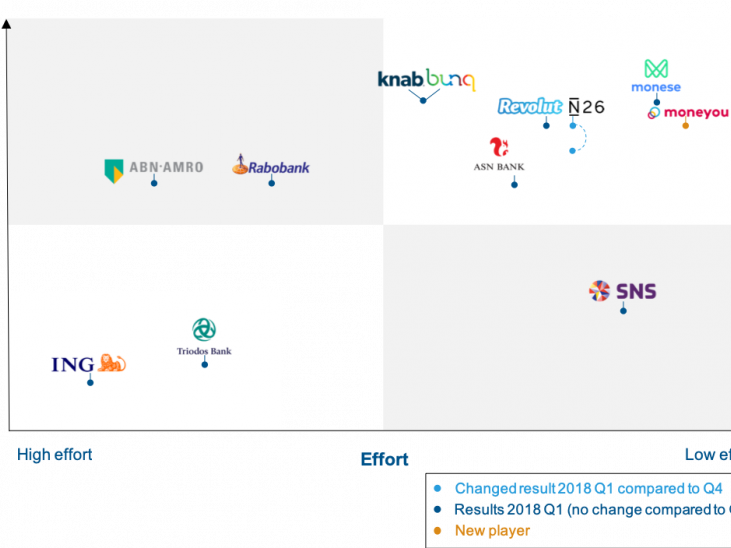

Insights Q1 INNOPAY Onboarding Benchmark

Although newer and smaller banks...

Lesen Sie mehr

Publication

|

Blog

Jeden Tag teilen mehr als eine Milliarde aktive Nutzer ihre Gedanken, Fotos, Nachrichten, Videos, Memes und mehr mit Freunden und Verbindungen auf Facebook. Mit Daten aus Girokonten wissen Banker, was ihre Kunden essen, wo sie ihre Kleidung kaufen und was sie online treiben. In der Welt von heute und morgen werden (persönliche) Daten durc...

Lesen Sie mehr

Publication

|

Blog

For the fifth year in a row, INNOPAY has contributed to the ShoppingTomorrow research program. Together with CM we hosted the expert group 'Digital Identity'. In this collaborative project a group of experts did research on how to implement a fully digital onboarding process for both B2B and B2C customer. This blog provides...

Lesen Sie mehr

Publication

|

Blog

Sollten sich Sicherheit und Komfort im Kunden-Onboarding-Prozess gegenseitig ausschließen? Definitiv nicht, meint INNOPAY.

Sicherheit und Komfort werden oft als Gegensätze gesehen. Mit den sich rasant entwickelnden Technologien sollte dies jedoch nicht länger der Fall sein. Es ist an der Zeit zu erkennen, dass Sicherheit und Komfort zwei...

Lesen Sie mehr

Publication

|

Blog

For many years, PSPs have had relatively easy pickings, charging significant markups to online merchants for handling their payment traffic. A large variety of players entered the market. In Germany, ±60 PSPs are active, and in the Netherlands 120 players either hold a license or are specifically exempted from license duty to act as PSP.

...

Lesen Sie mehr

Publication

|

Blog

Technology has enabled innovation, but Financial Institutions (FIs) are not using its potential to improve their corporate client onboarding processes. This is contrary to what we see in the retail market, where the digital transformation is proceeding at full speed. Just two examples include Rabobank which has enabled digital onboarding ...

Lesen Sie mehr

Publication

|

Blog

Financial service providers are challenged by Bigtechs to build international scale for their innovative products. Cross-border introduction of innovative digital payment and loan products is a difficult game however, as local implementations of the Anti-Money Laundering Directive (AMLD) and other regulatory requirements differ markedly b...

Lesen Sie mehr

Publication

|

Blog

Banks are investing heavily in technology to stay ahead when it comes to interacting with customers. Opening an account is one of the first interactions a new customer will have with an organisation. And it is a true cliché that ‘you never get a second chance to make a first impression’. So, you’d better do it right, right?

Our Digital C...

Lesen Sie mehr