Topics

- 0 results found

Publication

|

Blog

With the Open Banking initiative now well and truly underway, we’re gradually se...

Lesen Sie mehr

Publication

|

Blog

In der Welt des Zahlungsverkehrs und der Daten finden Innovationen, angetrieben von einem großen Trend, den Verbrauchern immer mehr Kontrolle über ihre Daten zu geben, schneller denn je statt. Laut Vincent Jansen, Partner bei INNOPAY, Mounaim Cortet, Leiter des Bereichs Open Banking und Karl Illing, Leiter INNOPAY Deutschland, ist Open Ba...

Lesen Sie mehr

Publication

|

Blog

In the last few months, Open Banking has seen considerable activity. Indeed, wit...

Lesen Sie mehr

Publication

|

News

Kurz vor dem Inkrafttreten des letzten Meilensteins der PSD2 wird es höchste Zei...

Lesen Sie mehr

Publication

|

Blog

PSD2 is the revised European directive for payment services, with the supporting...

Lesen Sie mehr

Publication

|

Blog

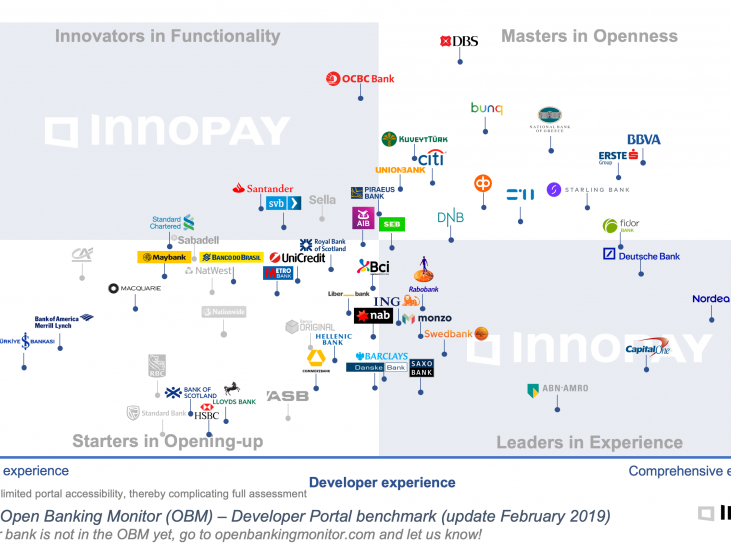

Looking back on a much eventful year in Open Banking; various banks have updated their Developer Portal in the last quarter of 2018, either by expanding the Functional Scope, by offering more APIs, or by introducing tools and features improving the Developer Experience. Predominantly with the shared goal of attracting more end-customers, ...

Lesen Sie mehr

Publication

|

Blog

Towards the first pan-European Open Banking based scheme

Imagine you’re taking an Uber at the airport, get to your destination and while you’re getting out of the Prius … ping… you receive a push notification from your bank that says € 32,78 was debited from your payment account. The full Uber experience, but no cards or wallets needed.&...

Lesen Sie mehr

Publication

|

Blog

This article was first published by the Paypers in the Open Banking Report 2018.

Lesen Sie mehr

Publication

|

Blog

PSD2 has been an important catalyst for banks to open up. While many banks in Europe are still focused on making the PSD2 deadline of September 2019, we see some leading banks move beyond compliance and shift towards Open API Banking. In this emerging Open Banking play, banks start to understand that enabling secure access to custome...

Lesen Sie mehr

Publication

|

Blog

This article was published in collaboration with Deutsche Bank.

Market disruption, client evolution and regulatory change mean that the banking and corporate world is preparing for an API and Open Banking revolution. Making a success of it will require both collaboration and standardisation.

Lesen Sie mehr

Publication

|

Blog

Senior bank executives are starting to understand that Open Banking will have ke...

Lesen Sie mehr

Publication

|

Blog

Jeden Tag teilen mehr als eine Milliarde aktive Nutzer ihre Gedanken, Fotos, Nachrichten, Videos, Memes und mehr mit Freunden und Verbindungen auf Facebook. Mit Daten aus Girokonten wissen Banker, was ihre Kunden essen, wo sie ihre Kleidung kaufen und was sie online treiben. In der Welt von heute und morgen werden (persönliche) Daten durc...

Lesen Sie mehr