Set for success: a compliant-by-design operating model helps Scale Ups to secure future growth

All Scale Ups eventually face the same challenges as they outgrow their Start Up status. How to continue acting nimbly and doing what they do best, whilst simultaneously retaining their growth curve and building trusted positions in their ecosystem? According to INNOPAY's Josje Fiolet and Willem Mosterd becoming and remaining a successful Scale Up relies on implementing a 'compliant-by-design' operating model that can manage constant change requirements in a sustainable way. Using their unique operating model (re)design methodology – Crosslinx ® – INNOPAY helps Scale Ups to avoid costly point solutions, and enables them to build capabilities to deal with change on a continuous basis by improving coherence between strategy and daily operations.

Growing from Start Up to Scale Up involves a range of challenges

Life is relatively uncomplicated for young dynamic Start Ups. They focus on building innovative products and services, the team is relatively small and everyone knows each other, and the ecosystem cuts them some slack as 'new kids on the block'. But once they outgrow their Start Up status, companies are confronted with a set of new and unfamiliar challenges.

Josje picks up the story: "For an organisation to successfully acclimatise to their Scale Up status, they need to figure out the answers to some tough questions:

- How to sustain their growth curve, and increase their relevance by maximising current value pockets?

- How to create a trusted position in their ecosystem, by being able to respond to new expectations and requirements from regulators, customers, partners and investors?

"Scaling fintechs will be particularly impacted by new regulations, such as the EU's Digital Finance Strategy which places the same regulatory burdens on all companies, regardless of scale and maturity."

Willem adds: "To really secure a growth position in the market, companies need to have trusted relations with their customers, clients, partners, the regulator and so on. And to meet the requirements of their ecosystem, they must continuously improve their organisation and the way they do business. This often impacts Scale Ups disproportionately for two main reasons:

- First, they have grown organically and tend not to have clearly defined structures within their organisations. As they increase in size, they need to overcome the loss of social coherence by implementing a sustainable operating model.

- Second, they need to grow into their new position in the ecosystem. Now they are expected to perform just as reliably as their established competitors, with a mature organisation and stable execution of performance."

Josje summarises: "Ultimately – if Scale Ups are not able to live up to the expectations of their ecosystem – this is about diminishing shareholder value. In response to each new demand, we typically see organisations implementing point solutions and putting in more people to resolve issues. This creates a higher cost/revenue ratio which isn't sustainable. And it creates complexity which makes previously very flexible companies begin to lose their competitive edge. Their ways of working now become an impediment, and this leads to diminishing shareholder value."

The right operating model is the best compass to navigate these new challenges

INNOPAY believes that the answer lies in designing a 'compliant-by-design' operating model which enables Scale Ups to respond to a wide variety of challenges on a continuous basis. A 'compliant-by-design' company is organised in such a way that it can implement new compliance requirements efficiently and effectively, without losing its ability to scale and execute its strategy. It requires them to move from perceiving compliance as a cost driver only, towards seeing it as a value driver.

Josje explains: "For example, when working with fintechs and scaling organisations we see that they often make compliance the responsibility of a single staff function. However, when you want to embed compliance as a value driver in your modus operandi, this means it must be fully embedded in the culture, tools and processes, governance and ways of working. Only by addressing all the elements in the operating model can you build a sustainable compliance capability that allows you to manage requirements and convince the ecosystem that you're committed and able to deliver on expectations".

Willem adds: "Organisations need to be proactive and show that they have an operating model which enables them to comply with new regulations and respond to partner requests and customer demands."

To help Scale Ups to achieve this, INNOPAY has developed a simple and effective methodology for operating model (re)design called Crosslinx. Crosslinx has proven its value to a wide range of client organisations, including Scale Ups which want to achieve scalable growth and need to acquire licences and regulatory approvals.

Crosslinx: a simple yet highly impactful methodology for operating model design

The Crosslinx methodology provides companies with a new way to look at their organisation: an holistic, activity-based approach that helps them to quickly develop a 'picture' of how all the components of their organisation interlink at both strategic level and operational level. This picture is the optimal basis for designing an effective operating model.

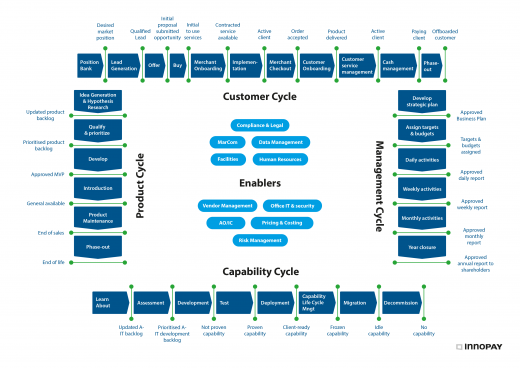

Josje explains: "When we help Scale Ups to (re)design their operating model, we begin by ensuring that they develop an agreed, holistic and structured view of the whole organisation. This begins with mapping all the activities within the organisation, and looking at how these contribute to value creation within four different cycles. Once each activity is clearly mapped and its relationship to other activities is understood, organisations can understand a) areas which are currently hindering their growth and how changing the operating model can help, and b) how complying with new regulations and requirements will impact all the connecting elements of their business. This enables them to manage changes proactively by ensuring that all the activities are balanced to optimise the results."

Crosslinx reduces the complexity of operating model design

Crosslinx has been specifically designed to work for organisations of different sizes and maturity levels. For Scale Ups, it focuses on helping them to accelerate what they do very well, whilst supporting them to grow and meet expectations at the same time.

"A couple of workshops is sufficient to trigger the conversation on how companies look at their organisation," says Josje, "and this immediately leads to tangible results as they rapidly develop a shared understanding of how the organisation is creating value and the role of each person involved in that process.

"Crosslinx fits seamlessly with the best practices that organisations are already applying. We don't try to replace those processes. Companies don't need new tools and technologies. Crosslinx complements and increases the value derived from their existing best practices. So they quickly get a tangible deliverable that they can start running with, rather than a lengthy exercise."

Willem adds that Crosslinx works particularly well for Scale Ups that need to acquire a licence: "First, it demonstrates to the regulator that you have a sound and controlled business, and you can provide them with a full overview of all your activities and control points. Second, you can show how you are embedding these compliance activities into your day-to-day operations. We know this is an approach which regulators really appreciate because we've done it many times with Scale Ups needing to acquire e-money licences, payment institution licences and credit licences".

Your strategic execution can be improved by rethinking your operating model

Josje and Willem summarise: "Scale Ups need to stop viewing compliance as a cost driver, and start seeing it as a potential value driver. It is essential to develop a 'compliant-by-design' operating model which is a) scalable, sustainable and will keep costs bearable, and b) will facilitate both future growth and the development of trust in their ecosystem. If they don't have a clear view of what their operating model is – and how the many components work together – they will continue to rely on point solutions. They need a pragmatic, future proof solution that can grow with them and keep all their stakeholders happy. Only by doing this can they be successful in the long-term."

To discuss the challenges and opportunities raised in this article, please feel free to contact Josje Fiolet (an experienced strategy execution consultant who supports organisations executing their strategies in the field of payments, identity and data; she is able to perceive and transition business and compliance as two sides of the same coin, and has supported many fintechs with acquiring their licences and regulatory approvals).