How banks can solve the “Onboarding Puzzle” in the German market

In the past few years new and innovative banks, also known as challenger banks, have entered the scene to disrupt the German consumer banking market. Even though a customer does normally not sign up for a new bank account every year, those new players have been recognised to attract and convert a rapidly growing digitally-savy customer base. While many incumbent banks are still struggling to orient themselves in the digital age, challenger banks have embraced new technologies to optimise customer-centric journeys, having built digital propositions from scratch.

INNOPAY developed a Benchmark that provides banks with essential insights into how to make a good first impression on customers. The first research focused on the Dutch retail banking market, where over the last year all banks made it possible to digitally open a payment account, using innovative solutions. Based on the expertise gained from the Dutch series, INNOPAY has enhanced its Benchmark model to reflect the progress observed and to account for the characteristics of the German market.

Our latest Benchmark, completed in Q3 2018, provides executives with an overview of their bank’s position within the competitive landscape and product managers or product owners with key learnings on how to improve the onboarding process based on best practice in the German market.

Six key actions have been identified that banks should execute in order to provide the prospective customers the best-possible onboarding experience and increase conversion rates.

- Eliminate all channel breaks to enable an end-to-end fully digital onboarding experience.

- Make required onboarding information and prerequisites transparent and understandable for the customer.

- Guide the customer through the onboarding flow and empower customer support to help prospects during onboarding in a quick and high-quality manner.

- Make use of tools that ease the process of data entry and eliminate errors.

- Enable customers to instantly login and start using the payment account after a successful onboarding.

- Deliver a consistent look and feel throughout the whole onboarding experience.

Find the sweet-spot within customer onboarding

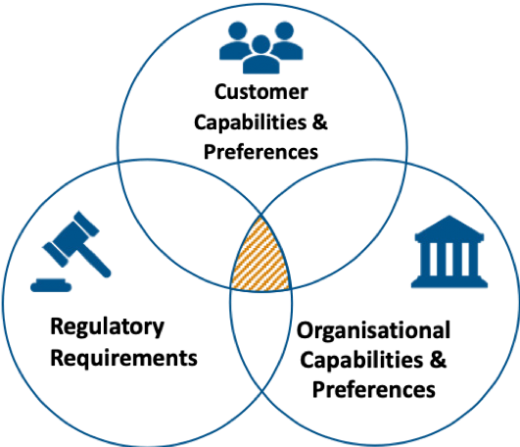

Not only is the onboarding process for many customers the first interaction with a bank, it is also transpiring the mission and strategy for an organisation and is key for any bank’s conversion rates. It is challenging for organisations to find the optimal way of offering their services online; they need to balance security, compliance and risk, while keeping a seamless user experience. Therefore, in order to optimise the onboarding process, the bank must find the right balance among (1) customer capabilities & preferences (2) organisational capabilities & preferences and (3) regulatory & risk requirements as shown in figure 1.

Considering and including the aforementioned three drivers in the right way, results in the so-called “onboarding sweetspot” and the ability for the onboarding process to serve as a competitive advantage. Banks find themselves in an environment of strong competition, fast changing customer expectations and a tightening belt of the regulatory framework. At the same time new technologies provide all players with the relevant tools to create a digital onboarding experience that has the potential to serve as a significant differentiator in German consumer banking landscape.

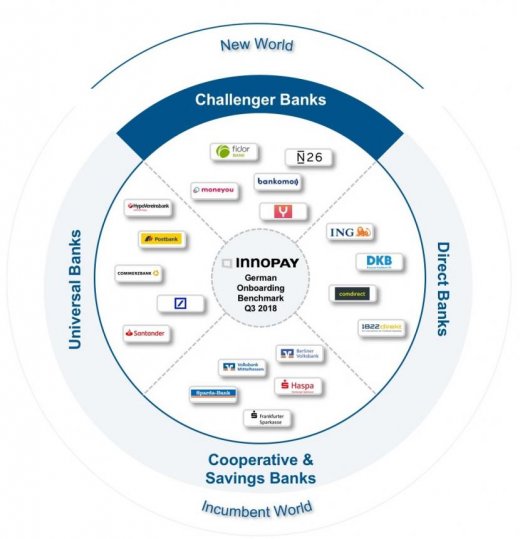

Challenger banks are ahead followed by two large incumbent banks

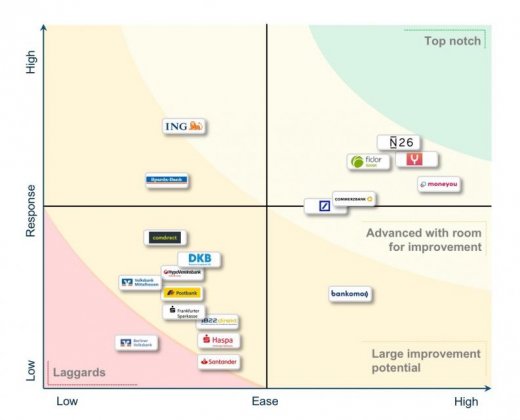

The INNOPAY Digital Customer Onboarding Benchmark shows that challenger banks such as N26, Yomo and Fidor are leading the pack, closely followed by the German ‘flagship’ universal banks Deutsche Bank and Commerzbank.

The Benchmark takes the specifics of the German banking market into account. Due to high fragmentation the results will be presented in four clusters: challenger, direct, cooperative & savings and universal banks.

Large variation among and within the four clusters

Challenger banks are leading the digital onboarding best practice within the German market

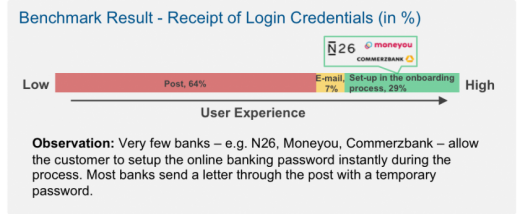

Most of the institutions in the challenger bank cluster are located in the upper right range and are thus leading the best practice in the German market. Challenger banks have mostly built their digital proposition from scratch using the latest technologies and could therefore gain a competitive advantage. Their onboarding processes offer a fast, seamless and convenient digital onboarding experience for their customers. Especially the ability of the customer to select the login credentials during the account opening process creates a faster and more seamless experience that is covered well by the challenger banks.

Researched challenger banks represent the highest scoring within the four defined clusters.However, none of the banks in this cluster has reached a top-notch position in the Benchmark, thereby every single participant can still improve. Even though many challenger banks are offering strong and customer-centric processes, some are still lacking transparency on the requested data and the key ability to deliver instant feedback [1] on the successful completion of the onboarding process.

Direct banks need to speed up the velocity of customer onboarding

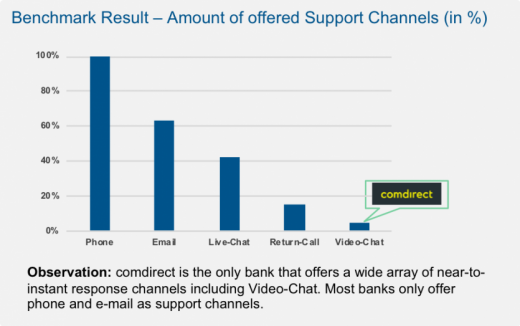

Most of the direct banks offer a transparent account opening process, in the sense that all required information is shown to the user upfront and the required fields are explained well. Furthermore the direct banks offer a high degree of flexibility and guidance, where the average amount of offered support channels stands out.

Not so long ago, “direct banks” were seen as the innovators, challenging established market actors. However, the results show they have been surpassed by new challenger banks. The direct banks are positioned higher than the average scoring across banks but are still behind on using their full onboarding potential. Direct banks should focus on improving the ease of the onboarding process to increase conversion. In some cases, a fully digitised process is present with instant feedback, nonetheless, multiple channel breaks [2] exist that negatively affect the scoring. These channel breaks, potentially caused by legacy systems, are severe as they contradict to offer a seamless and consistent process. This demonstrates an opportunity of improvement where the process is fully digitised and the account is instantly useable.

Universal banks show scattered results, while the larger banks are leading

The Benchmark shows a large dispersion within the cluster of universal banks, where generally larger universal banks are better positioned than smaller ones. The dispersion can be explained by (i) the broad definition of the chosen cluster labelling and (ii) different capabilities of process optimisation among universal banks. Larger universal banks might be able to allocate more resources to the adaption to new trends and technologies which are promoted by frontrunning performers in the Benchmark. They position themselves ahead of their smaller counterparts and closer to top performers by having more digitised and customer centric onboarding processes. Smaller universal banks mainly position themselves in the area of large improvement potential, still relying on the classical onboarding approach at their branches, regardless of having a digital onboarding process. In opposition to larger banks, a lack of knowledge was observed regarding the digital onboarding process among customer support representatives of smaller banks [3]. Larger banks have proven that ‘incumbent’ does not mean ‘old-fashioned’ and that smaller banks can learn from their larger counterparts.

Cooperative banks and savings banks score lowest and have the highest potential to improve the digital onboarding experience

The sample of cooperative banks and savings banks shows a lot of room for improvement for this cluster. They are primarily positioned as laggards in digital onboarding and have large improvement potential in all relevant areas investigated. Most cooperative and savings banks have similar defining scoring factors on which they can improve such as instant feedback, receipt of login credentials and customer support. For a majority of cooperative and saving banks the look and feel of the digital onboarding experience clearly lags behind its competitors from other clusters. This might be explained through a still prevelant focus on the branch experience within this cluster. Nevertheless, new ‘in-house challenger banks’ may allow cooperative and savings banks to catch up with the competition in the nearby future. Even though those banks are clearly lacking behind, openness for improvement may enable them to regain a higher position in the future.

Key recommendations to solve the onboarding puzzle and to create a great customer experience from the first moment

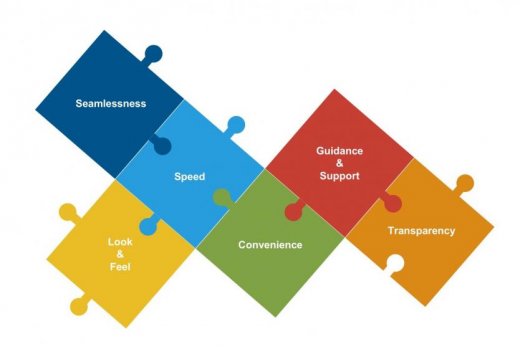

Although the four analysed clusters show a diverse range of results, INNOPAY has identified six general components and formulated six key recommendations that can help to solve the onboarding puzzle for all banks.

1. Develop an onboarding process that meets customer expectations and eliminates all channel breaks within the onboarding experience:

Banks will continue to acquire more and more customers via digital channels. Thus, it is crucial to design an account opening process that matches the customer expectation, who is nowadays used to onboard for other digital services and platforms like Spotify, Instagram, Amazon and others in a seamless way. What the before-mentioned services have in common is that they try to prevent any break in the channel during onboarding, but also within other customer journeys. Banks need to work on paperless onboarding processes as well as processes for which no physical signature is required. Every break in the channel will decrease customer conversion and satisfaction and likewise increase cost of the process.

2. Make required onboarding information and prerequisites transparent and understandable for the customer:

The potential customer needs to know upfront, right before the start of the onboarding process, what the bank expects from the prospect. Clear information and communication are key, so that the potential customer has all relevant details at hand and can run through the process in a smooth way. Thus, transparency is of highest importance and can be considered as a quick win to improve the onboarding experience and customer conversion.

3. Guide the customer through the onboarding flow and empower customer support to help prospects during onboarding in a quick and high-quality manner:

Another quick win for the banks is to improve the happy flow for prospects with guidance through the onboarding flow using, for example, progress bars, simple explanations and information boxes. The prospects should always know where they are currently positioned within the process and find information quickly, in case they do not understand why the bank is asking for certain information or why the bank requires the prospect to use a certain identification method. With regard to the unhappy flow, we found out that the employees were not able to answer rather simple questions in a high-quality manner [4]. A lack of knowledge and training on customer support level is critical and needs to be solved by almost all banks that we have assessed.

4. Make use of tools that ease the process of data entry and eliminate errors:

In order to limit drop-out rates during the process, banks should make use of more auto-filling and other tools to make data entry by the prospect as quick and easy as possible. Addtionally, errors can be prevented by various in-process validation tools to increase conversion and also to reduce manual efforts by the bank, leading to cost reduction.

5. Enable customers to instantly login and start using the payment account after successful onboarding:

Customers are used to instant onboarding experiences from other digital services. Thusalso in banking, the customer should be able to select the login credentials (e.g. PIN or username & password) during onboarding and instantly use them to login and interact with the service. However, some banks don’t give the customer the option to select the login details themselves and most banks need a few hours to a couple of days to fulfil KYC / compliance and other relevant checks.

6. Deliver a consistent look and feel throughout the whole onboarding experience:

A good UX is not only a matter of user interface design, but rather indicates a logical flow of the onboarding boarding process, relevant for the target customer. Simple, understandable and consistent look and feel needs to reflect the overall brand strategy and product/services offered.

---

[1] Waiting time for the customer after the identification process until he/she gets a response form the bank with information about the status of his application.

[2] Any switch of channel that interrupts the seamlessness of the onboarding process – i.e. a switch from digital to a non-digital channel (manual hard break) as well as a switch between digital channels (digital break) that can occur actively (where the prospect needs to get active to switch the channel) or passively (where the prospect is passive druing the channel break).

[3] To evaluate the unhappy flow of the onboarding process we included an investigation of the customer support service of all analysed banks in respect to its knowledge about the onboarding procedure.

[4] This observation is based on an inter-subjective rating of a sample of customer support calls conducted within our study.