Topics

Services

- 206 results found

Publication

|

Blog

Tech enthusiasts and industry leaders converged in Paris for the Apigee Summit o...

Lesen Sie mehr

Publication

|

Blog

Meta’s recent message to its European users, offering them a monetary transaction choice, reflects the evolving landscape of digital consciousness. However, this transformation is not so much driven by Meta’s desire for better digital world, but mainly a response to European regulatory pressure. So to what extent does this move restore th...

Lesen Sie mehr

Publication

|

Blog

Onboarding new customers has kept financial institutions busy over the last few decades. Identification and authentication efforts have risen substantially due to the emerging dominance of online channels and the associated risks of fraud. A widely adopted EU Digital Identity Wallet could increase the efficiency of identification and auth...

Lesen Sie mehr

Publication

|

Interview

As Director and Lead Data Sharing at INNOPAY, Mariane ter Veen helps organisatio...

Lesen Sie mehr

Publication

|

Video

In April of 2023, INNOPAY hosted in collaboration with De Nieuwe Wereld's YouTube channel and the University of Utrecht a talk show about the 'Threats and opportunities of Artificial Intelligence'.Journalist and philosopher Ad VerbruggeAd engaged in front of a live audience of Honours Program students from the University of Utrecht, in a ...

Lesen Sie mehr

Publication

|

News

Sharing data – whereby the rights holders retain control – offers tremendous opp...

Lesen Sie mehr

Publication

|

Blog

The EU’s AML/CFT framework presents the banking industry with a dilemma: how can banks fulfil their KYC obligations, while also protecting the confidentiality of client data? According to INNOPAY’s Vince Jansen, three emerging types of ‘trust tech’ could provide the answer for transaction monitoring. “Artificial intelligence offers the po...

Lesen Sie mehr

Publication

|

News

We are thrilled to announce a fruitful collaboration between INNOPAY and th...

Lesen Sie mehr

Publication

|

News

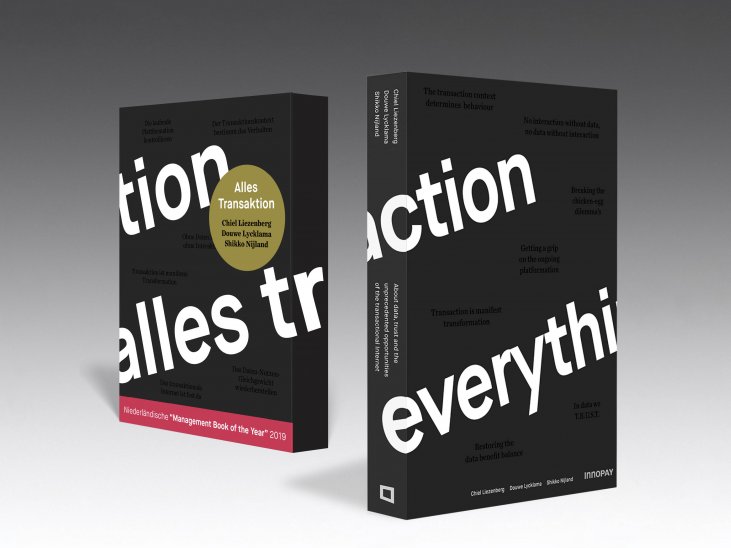

‘Alles Transaktion’ – Ein großer Erfolg in der Open Finance-Literatur, jetzt kostenlos herunterladen

INNOPAY feiert stolz den großen Erfolg seiner preisgekrönten Veröffentlichung ‘A...

Lesen Sie mehr

Publication

|

Blog

In May I had the privilege of delivering a keynote speech at the Slovenian DSI c...

Lesen Sie mehr

Publication

|

News

The latest episode of 'The E-Invoicing Podcast' by e-invoicing service provider ...

Lesen Sie mehr

Publication

|

Blog

Digital identity for people, things and organisations is increasingly critical i...

Lesen Sie mehr