Six criteria for selecting an API connectivity provider to power your PSD2 opportunities

When you are working on PSD2 opportunities, it is of the utmost importance to select the right API connectivity provider. Their technology capabilities can greatly assist you in launching a successful PSD2 proposition for your customers, while accelerating your development process and time to market. This blog helps you to apply the right criteria to inform this important strategic decision.

Once you have decided to outsource the API connectivity work (see our previous blog for insights in what considerations influence ‘make or buy’ decisions for API connectivity providers), you will discover that there are many different API connectivity providers, both with and without a PSD2 licence. That’s why it is so important to select the right API connectivity provider who will power your PSD2 opportunity. Note that there is no one-size-fits-all approach; the relevance and relative weighting of the selection criteria listed below must take the specific context and business requirements of the respective PSD2 opportunity into account. Additionally, bear in mind that service providers need to grow with your organisation as the PSD2 proposition matures and criteria evolve.

The six selection criteria

1. Connectivity reach

The reach of providers – that is, the number of connected banks per country – differs greatly, with many local and regional providers operating in the market. It is important that an API connectivity provider covers the geographical scope required for your PSD2 opportunity, as this ensures that you are not required to contract and integrate with multiple providers to establish the required reach among banks that you want to include in your service. API connectivity providers often prioritise their connectivity roadmap based on client demands. This is an important aspect to realise when you have strict timelines for realisation of your PSD2 opportunity.

2. Functional scope

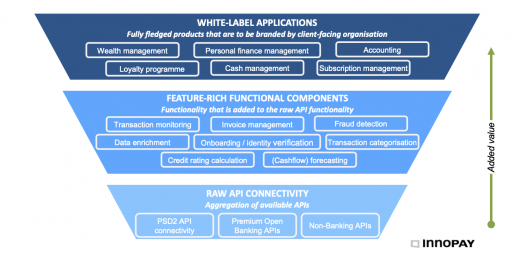

There can be differences between the functional scope of different API connectivity providers’ service offerings, as they often focus on additional white-label services on top of the core connectivity to bank APIs. Three types of white-label service offerings are typically distinguished:

- ‘Raw’ API connectivity: technical aggregation of available bank APIs for PSD2 account information and payment initiation. This is typically extended with other ‘premium’ bank APIs and/or APIs providing access to other organisations and respective data sources/capabilities. This functional offering forms a ticket to play for service providers and is more a qualifier than a differentiator.

- Feature-rich functional components: functionality that is added to the raw API functionality, such as specific processing of data or detailed analysis of payments data to identify patterns as a basis for value-added advisory services. Examples of service providers in this category include, among others, Invers, Fintecsystems, Plaid and Budget Insight.

- White-label applications: fully fledged products and capabilities that are offered as a service for branding by client-facing organisations (B2C or B2B). Examples of service providers in this category include, among others, Minna Technologies, Tink, Moneyhub Enterprise and Yolt Technology Services.

Figure 1 provides a high-level overview of the different services per category that are offered by API connectivity providers.

3. Licence-as-a-Service

As detailed in our previous blog, some situations do not require you to have your own licence to enable your PSD2 opportunity, in which case you can save costs and resources that would otherwise be involved in obtaining and maintaining a licence. If this applies to your situation, the API connectivity provider must have a PSD2 licence in order to support you. There are currently 89 parties operational in Europe that have a PSD2 licence and offer API connectivity services.

4. Connectivity to other data sources

PSD2 is a legal mandate for banks to open up specific data and functionalities for payment account information and payment initiation. There are, however, other valuable data sources available that could be relevant for your PSD2 opportunity, e.g. premium bank APIs that open up functionalities and data outside the scope of PSD2 and non-bank data sources from organisations operating in other sectors. Examples of such non-bank data sources are Chamber of Commerce, National Vehicle Authority and geodata. Some API connectivity providers offer connectivity to (a selection of) these additional data sources through various technologies (e.g. APIs, screen scraping, reverse engineering).

5. Cost

The pricing models used by providers vary widely. Some work on the basis of pay-per-use, others have a subscription model, and others use a hybrid form that combines fixed and variable costs. One-off implementation or consultancy/training costs are also common. Regardless of the different cost models, the most important factor affecting costs is the transaction volume. It is therefore wise to assess the expected transaction volume per type of service for your PSD2 opportunity before engaging with an API connectivity provider.

6. Organisation-specific requirements

As no two organisations are alike, your organisation may have specific requirements with respect to issues such as data protection, security, user experience, degree of control, risk management and compliance. It is important to identify these specific requirements and ensure that your API connectivity provider is able to meet all of them.

INNOPAY can help you select the right API connectivity provider

Partnering with an API connectivity provider can greatly accelerate the development and time to market of your PSD2 opportunity. INNOPAY can help you find the API connectivity provider that best fits your needs.

INNOPAY has extensive cross-sectoral experience in enabling organisations to reap the full potential of the opportunities enabled by PSD2. Our consulting services range from defining PSD2 strategies and identifying actionable business opportunities, and selecting the most suitable API connectivity provider for them to assisting organisations with obtaining their PSD2 licence and developing their propositions.