INNOPAY’s view on the implications of the EU Markets in Crypto-Assets Regulation (MiCA)

One of the main challenges facing crypto is the lack of a clear regulatory framework, as echoed by respondents in our INNOPAY/The Paypers Crypto Monitor. Recent events like the FTX collapse and Signature Bank shutdown have further highlighted the need to fill the regulatory void in the crypto market. Europe is leading the way in resolving this situation, having recently given the green light for the EU Markets in Crypto-Assets Regulation (MiCA). Following its publication in the EU’s Official Journal on 9 June 2023, it is expected to take general effect by the second half of 2024. In this blog, we outline INNOPAY’s view on the implications of MiCA for affected parties, based on our takeaways from the published legislative text and our experience with similar EU financial services legislation.

MiCA aims to provide Crypto issuers and CASPs with more legal certainty

The proposed Markets in Crypto-assets regulation (MiCA) targets crypto-assets which are not covered by any existing EU financial service legislation. It has four interlocking objectives:

- Promoting legal certainty

- Encouraging innovation and fair competition

- Instilling consumer and investor protection and market integrity

- Ensuring financial stability

Affected parties can fall under 4 separate, mutually inclusive categories

MiCA applies to both crypto-asset issuers and crypto-asset service providers (CASPs). Issuing includes public offerings and admission to trading of crypto-assets. With respect to CASPs, MiCA provides an exhaustive list of services giving rise to such qualification (e.g. operating a trading platform). However, some assets such as Central Bank Digital Currencies (CBDCs) and non-fungible tokens (NFTs) are excluded from this legislation. This exclusion has been hotly debated and will likely result in a further iteration of the legislation (i.e. MiCA2).

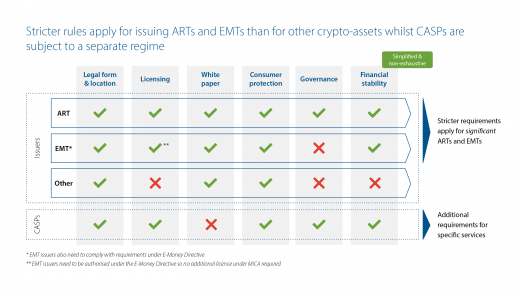

Crypto-asset issuers must meet specific requirements based on the type of asset they issue:

- Issuers of e-money tokens (EMTs) –i.e. a type of crypto-asset that purports to maintain a stable value by referencing the value of one official fiat currency (e.g. Euro Coin or USD Coin) – must first be authorised under the existing E-Money Directive, provide a white paper adhering to specific criteria, and comply with requirements related to consumer protection and financial stability.

- Issuers of asset-referenced tokens (ARTs) – i.e. a type of crypto-asset that purports to maintain a stable value by referring to the value of several official fiat currencies, one or several commodities or one or several crypto-assets, or a combination of such assets (e.g. Tether Gold) – need to be authorised by the local competent authority, be a legal entity established in the EU and provide documentation including a white paper meeting specific criteria. Furthermore, they need to adhere to requirements related to consumer protection, financial stability and governance.

- Issuers of 'other' crypto-assets – i.e. a legal person who offers to the public any type of crypto-assets or seeks the admission of such crypto-assets to a crypto-asset trading platform (e.g. XRP) – must be a legal entity and prepare a white paper adhering to specific criteria, as well as complying with requirements related to consumer protection. However, issuers of other crypto-assets do not need to apply for a licence.

CASPs must obtain a licence from the local competent authority, provide appropriate documentation, and adhere to ongoing requirements related to consumer protection, financial stability, governance and the specific service provided.

For the sake of completeness, even though it is outside the scope of this blog, we feel it is important to mention that MiCA also introduces a separate set of general rules to prevent market abuse involving crypto-assets.

Affected parties welcome the long-awaited regulatory clarity but face significant compliance challenges

With MiCA, the EU answers to the demand for a clear regulatory framework for crypto-assets. The regulation is therefore welcomed by numerous issuers and CASPs, including Binance, the world’s largest cryptocurrency exchange.

However, the clock is now ticking for in-scope parties to comply with the relevant requirements, and the road to compliance is paved with significant challenges. Firstly, affected organisations are likely to be subject to multiple – if not all – regimes, adding to the compliance burden.

On top of that, complying with MiCA involves dealing with local competent authorities in some way, such as the licensing procedure for ART issuers and CASPs. Each separate MiCA regime entails an extensive list of requirements. Upon closer examination of the requirements, it becomes clear that in-scope parties require specific knowledge they may not yet have in-house (e.g. legal).

Our experience with similar requirements under other EU legislation (e.g. PSD2) has shown that such licensing processes are complex and the organisational impact is often underestimated. In addition, a deep understanding of the local competent authority is required, particularly regarding ambiguous (governance) requirements which may be prone to interpretation differences across Member States. These licensing processes also tend to be rather protracted, especially when approval is not granted immediately but multiple iterations with authorities are required instead, as is the case with MiCA.

Lastly, in-scope parties face an important consideration regarding their desired operating model moving forward. Companies tend to skip this step, having already decided that they will only focus on having a strictly compliant setup. However, an alternative would be a more holistic ‘operationalisation of compliance’ approach. This has an advantage when it comes to adaptability. Integrating compliance in an organisation’s whole operational procedure allows parties to retain their licence and adapt to changing requirements more easily, which would create more breathing space for further iterations of MiCA (i.e. MiCA2). While this approach may not be the best option for everyone, it is an important consideration during the compliance process.

In-scope parties must act now to avoid suspension of their European operations

Considering the short timeline, prompt action is imperative for crypto-asset issuers and CASPs. The initial step involves identifying the applicable requirements and gathering the required knowledge – both specific expertise related to the requirements as well as an understanding of the local competent authority. Following this preparatory phase, an operating model should be designed which is compliant with the identified applicable requirements. Its design strongly depends on whether the organisation chooses to be strictly compliant or take a more holistic ‘operationalisation of compliance’ approach. Lastly, the new operating model must be implemented, followed by preparation of the corresponding documentation and licence application (if necessary). Given the short transition period of MiCA and the extensive lead time of the licensing process, applicants should ensure that their initial attempt to obtain a licence is successful.