How #openness will change insurers’ pricing strategies

“Data, whether it's location-based or behavior-based data, will help provide solutions, whenever and wherever they occur.” – Brett King, author of breaking banks

Although insurers are improving significantly on enhancing the customer experience during onboarding, pricing still seems to be the most important differentiator for customers. Based on INNOPAYs experience with open business models and open architecture in banking and other industries, we believe that consuming APIs in an open ecosystem world is the next step for insurers in offering more personalized and thus better priced products to their customers. Insurers have to (re)set their sights and acknowledge that customer centricity is not about offering integrated propositions but is moving towards many to many solutions in open ecosystems.

The premium a customer has to pay depends for a large part on the risk and thus claims associated with that customer or object which is insured. To stay ahead of competition and to allow for more personalised pricing, insurers need to continuously tap into new data sources which can better predict that risk. There are evident and simple ‘discriminators’ for certain types of claims, for example a working fire alarm to avoid damage due to fire or driven mileage in a car which directly relates to the chances a driver is involved in an accident. Having insight in new data sources for these discriminators during onboarding of a new customer would allow insurers to manage the risk better and offer a more personalised premium to customers.

One new source of insights in these discriminators could be open banking data which INNOPAY explored in a previous blog [1]. Another relatively new and growing source is the IoT market. For 2020, the installed base of Internet of Things devices is forecast to grow to almost 31 billion worldwide [2]. Insurers and InsurTech players (like Neos home insurance in the UK [3]) often in combination with (re)insurance companies, are increasingly developing Internet of Things (IoT) data-based and integrated (end-to-end, including dedicated hardware) insurance solutions but so far success in scaled adoption of these one to one propositions is limited.

These new sources of data for pricing discriminators are increasingly shared in open ecosystems with open APIs. Ecosystems are growing and are predicted to account for $60 trillion in revenues by 2025, or roughly 30 percent of all global revenues [4]. Open API strategies in these ecosystems thus bring numerous opportunities for companies who want to extend their business model or want to increase the relevance of their product or service for their customers. By opening up, a new network of companies which offer integrated propositions can be created. A well-known example of the latter is the open API of the Philips Hue lamp. When Philips opened up this API, a lot of new services were created by other parties. This made the lamp more valuable for Philips’ customers because it had more use cases which lead to more sales and a virtuous circle of growth.

In this open ecosystem world, it is hard to impossible to convince insurance customers to buy into an integrated (end to end) insurance IoT proposition and create a hardware lock-in. This results in a slow adoption rate for the current insurance IoT propositions and again translates to slow and sub-scale new book building and thus shareholder value destruction. Insurers have to (re)set their sights and acknowledge that customer centricity is not about integrated propositions but is moving towards many to many solutions in open ecosystems.

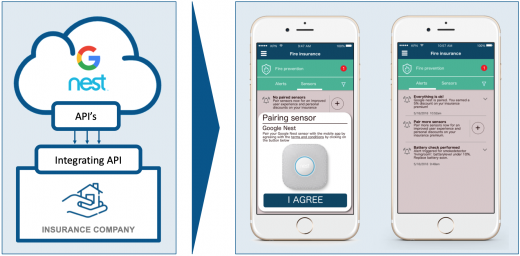

An example of an open ecosystem opportunity in customer’s homes is Nest (see Fig. 1), the smart thermostat that learns a customers’ schedule using predictive analytics to ensure that the house reaches the desired temperature when coming home. Nest has an open API where insurers, with the customers consent, could tap into to see if they have that working fire alarm (and provide a better priced insurance product).

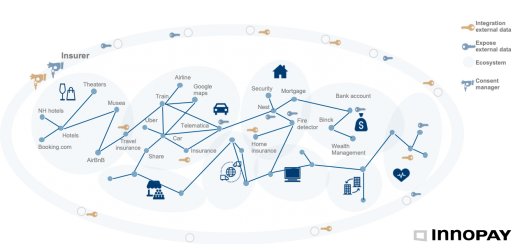

Insurers are wise to watch out for other open APIs in relevant ecosystems they can consume and start learning. For insurers consuming these new APIs in an open ecosystem allows to gather new data attributes and discriminators, needed to create a personalised customer profile and predict the number and size of claims more accurate. Eventually this will lead to becoming an open insurance company with data integration points in multiple ecosystems (see Fig. 2).

There are a number of questions coming into play for insurers when considering to consume APIs in order to increase customer relevance and offer more personalised premiums.

- API organisation: consuming open APIs requires a different mindset as value is not developed in house, but seeked outside. How to allow for an “outside-in” point of view, providing value to the customer by responding to their needs?

- Customer experience: sharing data with their insurer should make life easier for customers. How to allow for a seamless integration of API related questions in the onboarding process and maximise conversion, especially when the insurance is not sold directly? (e.g. via price comparison websites or intermediaries)?

- Data value balance: only when customers get something valuable in return they will be willing to share data. How to provide for this balance and convince customers of the added value of these services, in a time where GDPR comes into effect and customers are becoming more privacy sensitive than ever before?

- Consent management: in line with GDPR, customers need to provide explicit consent when sharing data. How to facilitate this in a customer friendly manner and register consent internally in line with regulatory requirements?

- Data analytics: when provided access, insurers will gather more relevant data from their customers. How to ensure these are turned into relevant insights and a more personalised offering to the customer?

- Business model: developing the capability to consume APIs and offer more personalised services to customers is a competitive asset. How to capatilise on these capabilities and come up with new business models and revenue streams?

- InsurTech cooperation: different InsurTechs are already building capabilities for consuming APIs which insurance companies could leverage in their go-to-market strategy. It is important to understand the role they will play in the insurer’s value chain

These considerations show that improved personalized pricing during customer onboarding by consuming open APIs is not an easy thing to do. But it’s a fact that open ecosystems are forming and being present is a must to stay relevant. Based on INNOPAY’s experience with open business models and architectures we know that when done well, the advantages and benefits are endless. Both to the customer as to the insurer.

Want to explore what #openness can do for you? Feel free to reach out to Maarten Bakker (maarten.bakker@innopay.com/ +31610981431), we are more than happy to discuss.

[1] https://www.innopay.com/en/publications/insurance-and-open-banking-wave-seven-use-cases

[2] https://www.statista.com/statistics/471264/iot-number-of-connected-devices-worldwide/

[3] https://neos.co.uk/

[4] https://www.mckinsey.com/business-functions/mckinsey-analytics/our-insights/competing-in-a-world-of-sectors-without-borders