Topics

Services

- 420 results found

Publication

|

Blog

PSD2 has been an important catalyst for banks to open up. While many banks in Europe are still focused on making the PSD2 deadline of September 2019, we see some leading banks move beyond compliance and shift towards Open API Banking. In this emerging Open Banking play, banks start to understand that enabling secure access to custome...

read more

Publication

|

Blog

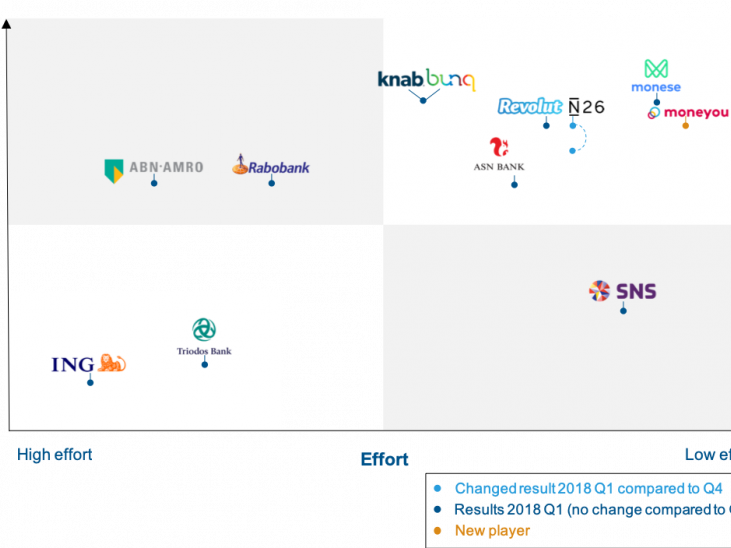

Where newer and smaller banks used to outclass the incumbent banks regarding the onboarding process, the recent INNOPAY benchmark shows a comeback of the established players. By now, there is no longer a need to visit the office to open an account. Now the question is: did the larger banks manage to compete with the challengers?

read more

Publication

|

Podcast

In episode #1 of INNOPAY’s “Meet the Vendor”, onboarding team lead Guy Rutten talks to Maarten Wegdam, founder and director of Innovalor. Innovalor is the company behind ReadID, an NFC chip reader that lets you onboard in seconds.

In our series “Meet the Vendor” we introduce you to parties in the market that can help improve yo...

read more

Publication

|

Blog

“Data, whether it's location-based or behavior-based data, will help provide solutions, whenever and wherever they occur.” – Brett King, author of breaking banks

Although insurers are improving significantly on enhancing the customer experience during onboarding, pricing still seems to be the most important differentiator for customers.&...

read more

Publication

|

Blog

This article was first published in The Paypers which features thought leadership editorials from ecommerce and payments industry professionals.

The concept of Open Banking and its potential grows steadily on corporate banks. PSD2 has been an important catalyst for banks in opening up, however, it forced them to focus on complying first,...

read more

Publication

|

Blog

This article was first published in the legal journal Payments & FinTech Lawyer (04/04/18)

Fostering an innovative environment: a pragmatic guide to embracing innovative CDD technologies while effectively managing the associated risks

Financial institutions are investing heavily in technology to improve one of their initial interact...

read more

Publication

|

Blog

Insights Q1 INNOPAY Onboarding Benchmark

Although newer and smaller banks...

read more

Publication

|

Blog

For the fifth year in a row, INNOPAY has contributed to the ShoppingTomorrow research program. Together with CM we hosted the expert group 'Digital Identity'. In this collaborative project a group of experts did research on how to implement a fully digital onboarding process for both B2B and B2C customer. This blog provides...

read more

Publication

|

Blog

Should security and convenience exclude each other in the customer onboarding process? Josje Fiolet, Digital Onboarding lead at INNOPAY, says “no”.

Security and convenience are often seen as diametrically opposed. However, with rapidly evolving technologies coming into play, this should no longer be the case. It’s time to reali...

read more

Publication

|

Blog

Technology has enabled innovation, but Financial Institutions (FIs) are not using its potential to improve their corporate client onboarding processes. This is contrary to what we see in the retail market, where the digital transformation is proceeding at full speed. Just two examples include Rabobank which has enabled digital onboarding ...

read more

Publication

|

Blog

Financial service providers are challenged by Bigtechs to build international scale for their innovative products. Cross-border introduction of innovative digital payment and loan products is a difficult game however, as local implementations of the Anti-Money Laundering Directive (AMLD) and other regulatory requirements differ markedly b...

read more

Publication

|

Blog

Banks are investing heavily in technology to stay ahead when it comes to interacting with customers. Opening an account is one of the first interactions a new customer will have with an organisation. And it is a true cliché that ‘you never get a second chance to make a first impression’. So, you’d better do it right, right?

Our Digital C...

read more

Let's get in touch