Yes, the EU Digital Identity Wallet is coming!

European Commission votes in favour of adopting the eIDAS revision

On Thursday, 29 February, the European Commission (EC) voted in favour of revising the eIDAS regulation. eIDAS aims to facilitate a harmonised approach for digital identity across Europe through the European Digital Identity Wallet (EUDIW). The EUDIW is designed to offer both citizens and legal entities a secure and user-friendly method for authenticating and sharing their data. Importantly, it empowers users to maintain full control over their personal information. The EUDIW has many potential use cases such as opening a bank account, renting a car or checking in to a hotel.

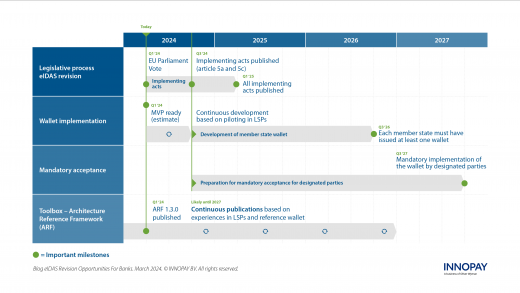

The acceptance of the revision by the EC allows the eIDAS process to advance towards implementation and acceptance. According to the indicative timeline (see figure showing the timeline), the EC will detail the required technical and operational standards through implementing acts within six months of the regulation taking effect.

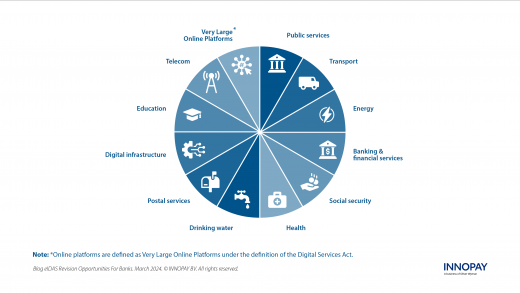

Each Member State must issue at least one European Digital Identity Wallet within 24 months of the Implementing Acts entering into force. And perhaps even more importantly, it will become mandatory for organisations in certain sectors (see figure showing the sectors of designated parties) to accept the wallet 36 months after publication of the Implementing Acts.

Although the meaning of ‘acceptance’ will differ per sector, organisations (both public and private) in designated sectors must accept the EUDIW for the provision of services where strong user authentication for online identification is required. Examples include use of the EUDIW for logging in to online services in the public domain and the energy sector, or for onboarding customers and the authentication part of payments in the financial sector.

As of today, organisations classed as designated parties will be under growing pressure to ensure EUDIW compliance within the indicated timeframe. They will need to dedicate significant effort and resources to aligning their operations with EUDIW acceptance. Creating an effective strategy – whether by partnering with wallet intermediaries or identity brokers, or by constructing the required infrastructure in-house – demands a thorough examination of the organisation’s operating model, along with the intended strategy related to eIDAS revision and the EUDIW.

INNOPAY has extensive experience with all of this and more. We are the one-stop shop for strategy, implementation, scheme development and product development concerning all aspects of the eIDAS revision.

If you’re interested in delving into the requirements and opportunities that the eIDAS revision and the EUDIW present for your organisation, please reach out to me.