Digitally transforming the corporate client onboarding process: where to start?

Technology has enabled innovation, but Financial Institutions (FIs) are not using its potential to improve their corporate client onboarding processes. This is contrary to what we see in the retail market, where the digital transformation is proceeding at full speed. Just two examples include Rabobank which has enabled digital onboarding since the end of 2017, and Moneyou (a daughter company of ABN AMRO Bank) which has recently launched its Beta app through which all processes can be carried out, including onboarding.

|

The market for corporate client onboarding seems to be less transparent than for retail onboarding, which is a shame because a lot can be learned from your peers. If you are curious to know how your onboarding process is performing, including in comparison with other players, fill in the INNOPAY corporate client onboarding survey. |

This difference in state of affairs between retail and corporate onboarding is somewhat surprising, because FIs, such as banks, PSPs, merchant acquirers and insurance companies also have access to a wide range of new technologies to improve corporate client onboarding. With Fintechs already offering seamless experiences pressure is increasing for FIs to innovate. Not to mention the Bigtechs who might enter financial services in the nearby future.

The established players’ current processes are time-consuming, costly and deliver a poor customer experience. Regarding the customer experience INNOPAY recently outlined six causes for a bad customer experience. We suggested that FIs should set sail to redesign their onboarding processes if they want to improve the customer experience and create differentiating processes like Fintechs do. An improved onboarding process will lead to increased conversion, faster time to revenue and increased cross-sell and upsell. As a follow-up to that article, this blog elaborates on what a great corporate client onboarding experience involves and where to start when (re)designing your process.

Digital transformation at FIs vs Fintechs

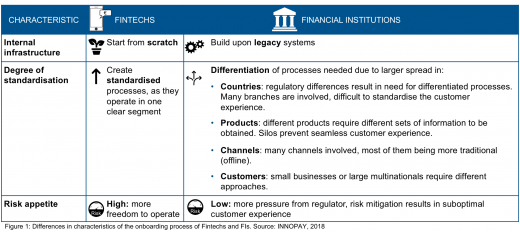

Although digital is the ‘new normal’ from a customer point of view, FIs are struggling to deliver on that promise because they have a different modus operandi compared to Fintechs, as visualised in Figure 1.

The main difference is that the more established FIs build upon a plethora of legacy systems. A flexible and scalable IT platform is missing, making it more challenging to integrate new technologies and provide a seamless experience. A related issue is the lack of a defined ‘golden source’ for client data, as FIs continue to operate across siloed data sources making a customer-centric overview difficult.

Another difference is that generally speaking, FIs have a larger existing customer base and a more wide-spread product portfolio across different jurisdictions and countries. Where Fintechs can offer more standardised processes, FIs need to have a flexible process, tailored to the specific context. As this is difficult to achieve, FIs choose to maintain a ‘one size fits all’ approach, with suboptimal experiences for their customers.

With a larger customer base, FIs automatically maintain different risk profiles whereas newer players maintain a single profile because they often focus on one clear customer segment. Consequently, FIs often choose the safe side over the more innovative approach. It’s the well-known balance between risk and usability.

Digitisation is key

Although redesigning the corporate client onboarding process is challenging, there are many ways to start making a difference. A company’s overall ambition should be to fundamentally change and digitise the process in order to be able to enhance the customer experience and reduce internal complexity.

Digitisation (embracing new technologies and automating processes) will affect the onboarding process in multiple ways, for example:

- Automated risk profiling reduces the level of manual research needed, consequently reducing the onboarding lead time for the customer;

- New formats for data exchange increases the ‘first time right’ principle because they improve the quality of data;

- More flexible architecture allows for differentiated processes, tailoring the process to the needs of the customer.

Keep in mind, not all changes have to be drastic. INNOPAY advises the following actions:

- The first step is to find quick wins for optimising your current process. Use analytics and talk to your customers. Frequent examples include improvement of design, minimising requested data and finding alternatives for widely available client services;

- Develop design principles in line with the corporate mission and vision. This will help to keep the end goal in mind during redesign and ensure that incremental improvements are in line with your mission and vision;

- Find out what technologies are used by other companies, and then consider which ones you like and can incorporate. You will be surprised by what you can learn from your peers;

- Follow a risk-based approach. Take a position on your required level of compliance and risk appetite. For instance, can your the process be less heavy on the KYC procedures for low-risk customers?;

- Taking all of the above into consideration, begin redesigning your process and follow a gradual implementation.

INNOPAY wants to help you with your digital transformation and understand how your customer experience can be improved.

Are you curious to know where you stand in relation to your peers and competitors? Fill in our corporate client onboarding survey. This survey will provide you with insights about your benchmarked position on digitisation and customer experience. You will receive the results and your relative score towards the benchmark. Stay in touch for our next blog with high-level results on the current state of affairs in corporate client onboarding.